Must-See Cannabis Investing Strategies

Legal pot gross sales within the U.S. have hit $four billion and are projected to hit $25 billion in lower than a decade.

Silicon Valley enterprise capitalists need in on this motion.

Big cash VCs money in and money out rapidly. Long earlier than most catch whiff of the chance.

But not in the present day!

Ray Blanco, our resident marijuana business professional, will let you know why.

Read on beneath for extra.

Regards,

Amanda Stiltner

for The Daily Reckoning

Why Pot Investing Is Silicon Valley’s New Target

By Ray Blanco

What do Silicon Valley behemoths like Uber, Facebook, SpaceX, Airbnb and Spotify have in frequent with a handful of tiny pot corporations?

They’ve acquired the identical buyers…

It’s true.

Some of Silicon Valley’s hottest enterprise capital funds are investing within the marijuana business proper now. These aren’t fly-by-night operations, both — they’re the heavy hitters. I’m speaking about Peter Thiel’s Founders Fund, Tusk Ventures, DCM Ventures and Y Combinator.

These enterprise capital funds (and others) have collectively invested tons of of hundreds of into the marijuana market.

And as I’ll clarify in a second, it is a very good improvement for us.

The enterprise capital angle is an enormous deal as a result of simply a few years in the past, it will have been fully unthinkable for these mainstream funds (and their very mainstream, very wealthy buyers) to be pouring cash into the pot market. But as you recognize, lots has modified within the final couple of years.

Today, New Frontier Data is projecting that authorized pot gross sales will balloon to greater than $24 billion by 2025. And that doesn’t even depend the businesses that promote rising gear and supply secondary companies to the pot market.

It’s not arduous to see why enterprise funds are falling throughout themselves to put money into rising pot corporations.

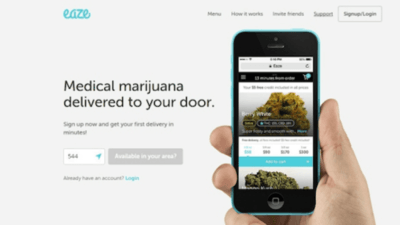

The poster little one for venture-backed pot proper now's Eaze:

Eaze is a medical marijuana supply firm — it’s mainly Uber for pot. Customers order on-line and a background-checked driver brings the medical marijuana from a neighborhood dispensary to the shopper’s home. They additionally present an app that may join smartphone customers with a dwell physician and subject a medical marijuana card for $29.

In different phrases, Eaze is making it extremely simple for shoppers to legally entry medical marijuana. It’s not arduous to see why that enterprise is more likely to be a money cow…

But Eaze isn’t publicly traded. We don’t have entry to it, or to lots of the different tiny marijuana companies that enterprise funds are investing in proper now. So you would possibly understandably be questioning why this VC push is an efficient factor for us.

It all boils down to at least one phrase: exit.

Venture capital and personal fairness funds aren’t within the enterprise of working companies. In different phrases, they need to make investments, assist a tiny firm develop after which money out. That’s central to their mannequin.

One of the most typical methods for VCs to exit an funding is thru an IPO. That means we’re going to have extremely highly effective, linked enterprise funds pushing a bunch of high-quality marijuana-related shares onto the inventory market within the intermediate time period.

That’s clearly a great factor for us.

And it’s more likely to increase demand for the tiny pot shares that already commerce in the marketplace.

Market situations proceed to be quiet proper now — and never only for pot shares, both. But that’s short-term. The marketplace for cannabis shares is a tidal wave rising within the distance. The tide could ebb and movement within the meantime, however when that tidal wave hits, it’s going to unleash revenue alternatives like most buyers have by no means seen earlier than.

In the meantime, we’ll proceed to be tactical to convey you essentially the most up to date information shifting the needle.

To a vivid future,

Ray Blanco

for The Daily Reckoning

Must-See Cannabis Investing Strategies

Comments

Post a Comment